swap in forex means

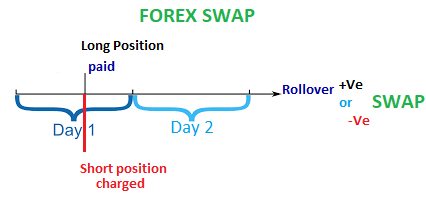

Forex swap is not actually a physical swap. Short swaps these are used when you have an open position that you have shorted gone short.

Currency Swap Meaning And Benefits Foreign Exchange Financial Management

What is swap in Forex.

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

. A swap in forex is an interest charge for holding an open position overnight. Lets Partner Through All Of It. Swap long used for keeping long positions open overnight and Swap short used for keeping short positions open overnight.

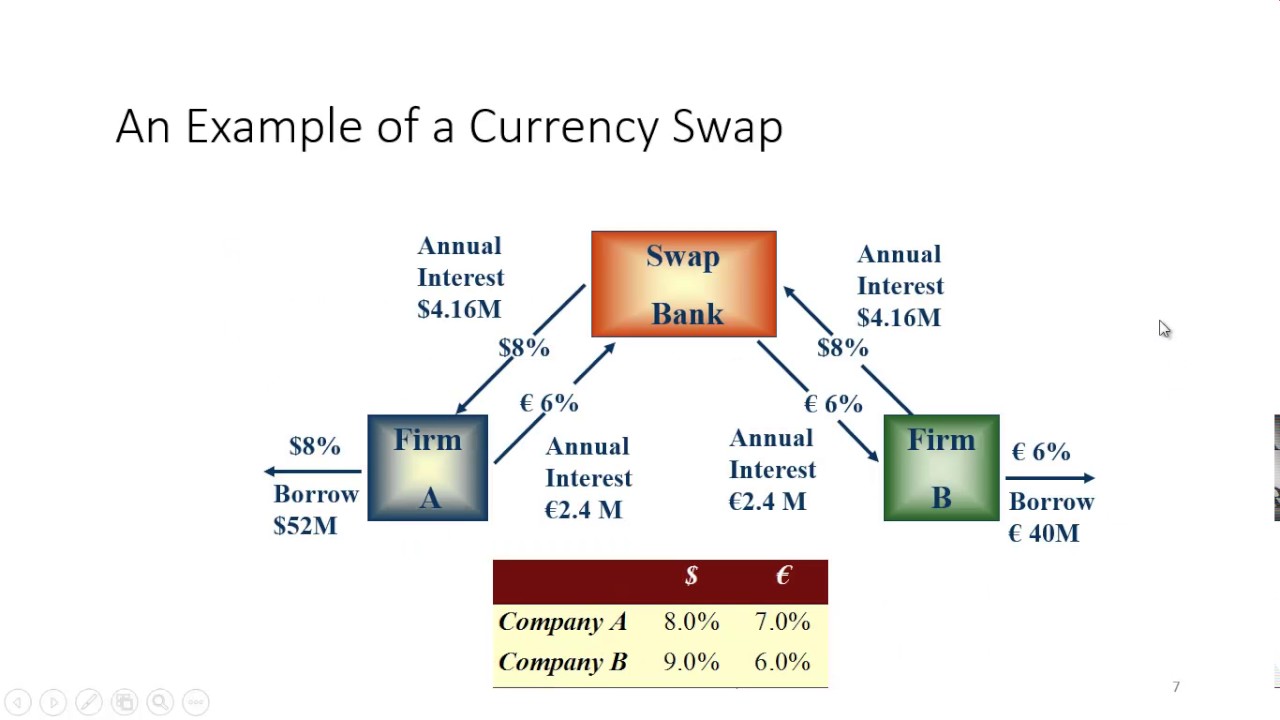

The interest-rate differential will be applied on the traded pair and trade direction thus trading accounts will be credited or debited. SWAP Contract InterestRateDifference Commission 100 Рrice DaysPerYear SWAP 100000 075 025 100 11200 365 307 USD. How to calculate a currency swap.

Each Forex pair has its own swap charge affected by market conditions and the interest rate associated with countries of the chosen Forex pair traded. However there is no need for the real delivery of the currency in case of speculative trading speculative trading is something that you are about to start. This amount is usually bigger for exotic pairs than for majors.

When trading Forex or other CFD Contract for Difference financial instruments swap also known as rollover refers to the interest paid or received for keeping a position overnight. The interest difference is 06 410 35. The brokers commission varies so.

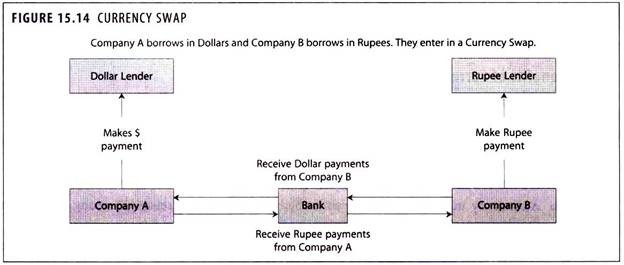

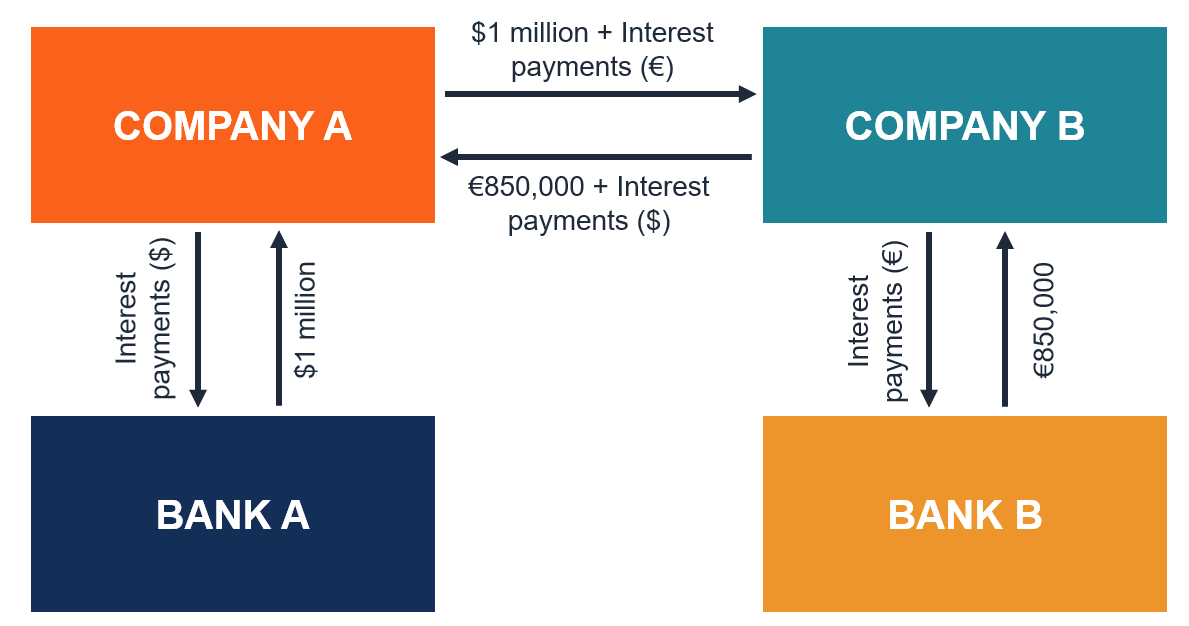

Swap is an exchange of two items between counterparties. The first leg the near leg involves the two parties swapping. The charge is applied to the nominal value of an open trading position overnight.

Swap position size x interest difference brokers commission 100 x price days per year Your position size is 10000. The size of the commission is a variable. On Forex a marginal system of trading is used which allows using loaned money in the form of large leverage.

When your long position on EURAUD is rolled over to the next day 307 will be debited from your trading account. Now lets take a closer look at how the total swap value is calculated on Forex for a sell trade in the EURUSD currency pair. Trading 1 mini lot or 10000 units of GBPUSD long with an account denominated in USD.

You already know that FX trading is simply trading currency pairs in order to make money. In this case he has to pay a. When trading on margin you receive interest on your long positions while paying interest on short positions.

Every currency pair will have a different Swap Rate that is applied to either Long or Short positions. These swaps come in two forms. An FX swap or currency swap involves two simultaneous currency purchases one on the spot rate and the other through a forward contract.

Forex Trading Strategy Definition. Find a Dedicated Financial Advisor Now. The difference between the interest rates of two countrys currencies is called the interest-rate differential.

A FX swap or Forex swap is a foreign exchange derivative traded between two parties usually financial institutions. A currency pair such as EURUSD means you need to buy euros and sell dollars at the same time in a long position or sell euros and buy dollars at the same time in a short position. The Forex swap or Forex rollover is a type of interest charged on positions held overnight on the Forex market.

For forex heres the formula to calculate swap. We hope that you have enjoyed the above article explaining the swap in. They are expressed in pips per lot and vary depending on the financial instrument.

However that is just the tip of the iceberg. The price for the currency pair is 11920. SWAP short Lot quote currency rate - base currency rate - markup 100 current quote.

Together they lend and borrow an equal quantity of money in two different currencies over a specified time period. The net interest difference is known as the carry and traders seeking to profit from this are known as carry traders. It means that all the deals are made with the actual delivery of the currency the next workday after their execution.

Long swaps these are used when you have an open position that you have bought gone long and kept overnight. This is the reason why most traders refuse to prolong a deal until the next day. How to Calculate Swap.

Find A Dedicated Financial Advisor. A forex swap is a commission or rollover interest charged by a broker for extending a traders position overnight. A Swap in Forex is sometimes referred to as a Rollover as you roll the trade over to the following day.

Depending on the swap rate and the position taken on the. If playback doesnt begin shortly try restarting your device. We will use this formula.

Instead a swap in Forex is an interest fee which needs to either be paid in or will be charged added to your account when the days trading comes to an end. Unlike the Bid and Ask prices which update several. What is swap in forex trading.

It is the interest that a trader earns or pays for holding a trade or keeping a position open overnight. Sometimes traders refer to this form of swap as the cost of carrying or the rollover rate. In finance a foreign exchange swap forex swap or FX swap is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates normally spot to forward and may use foreign exchange derivativesAn FX swap allows sums of a certain currency to be used to fund charges designated in another currency without acquiring foreign exchange.

A foreign currency swap is an agreement to exchange currency between two foreign parties often employed to obtain loans at more favorable interest rates. A swap in forex refers to the interest that you either earn or pay for a trade that you keep open overnight. Swap is an interest fee that is either paid or charged to you at the end of each trading day.

The swap charge is heavily influenced by the underlying interest rate corresponding to each of the two currencies involved. Ad Life Is For Living. Swap As An Interest Fee In Forex.

It depends on the gap between central bank rates in the countries whose national currencies you are trading. Thus when a position is moved to the next day the rules of interbank crediting come into force. So you will either be paid out.

Do Your Investments Align with Your Goals. The swap agreement has two legs. Brokers often update the Swap Rates in their trading platforms to reflect the market.

Calculation of Forex Swap. Swap Pip Value Swap Rate Number of Nights 10. Read on for explanation what is swap in forex.

A variety of market participants such as financial institutions and their customers multinational companies institutional investors who want to hedge their foreign exchange positions and speculators use foreign exchange swaps. Each currency has its own interest rate and each forex transaction involves two currencies and therefore two different interest rates. So a swap in forex trading is the interest that you pay or receive for keeping an open trade overnight.

The swap charge is applied should you hold the position at the daily rollover point which is 0000 server time and known in. Secondly the Forex swap also depends on the conditions under which your broker works with crediting organizations. A similar swap is also charged on Contracts For Difference CFDs.

The Forex Swap Explained. For instance a trader wants to keep a position open until the day to follow. A swap on Forex is an operation of money depositing or withdrawal for moving an open position to the next day.

Transactions on the Forex market are made on Spot terms. Swap Cost in Forex. Calculating the swap fees on a short position.

There are two types of swaps. In this definition swap is the interest that a trader pays or earns at the time of the rollover. However the meaning of swap in trading be it money market stocks or forex is slightly.

What Is Forex Swap Finlogic Net Forex News Swap

Currency Swap Quantra By Quantinsti

Swap Definition Forexpedia By Babypips Com

Currency Swap Contract Definition How It Works Types

What Is Swap In Forex Trading With Examples

What Is A Swap How Can It Benefit Us In Trading Forextrade1

What Is Swap In Forex Trading How Does It Works

/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)

Currency Swap Vs Interest Rate Swap

What Are Swaps In Forex Forex Academy

Do You Pay Swap Fees In Forex Every Time You Hold Overnight Or Do You Pay Only Once And Then You Can Hold On To It Forever Quora

Would You Be Interested In A Circus Swap In Forex Double In A Day Forex

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)